With the economic destruction of COVID-19 virus comes opportunity, a rare opportunity to very easily turn the negative into a positive from an estate planning and business succession perspective.

Today, valuations of marketable securities have taken a massive hit (20% – 30% lower). Valuations of the vast majority of closely-held family businesses would certainly follow suit by any appraiser. Additionally, interest rates are now at historic lows in today’s environment. Specifically, the IRS-mandated interest rate used for estate planning purposes is between 0.25% and 1.15%, as of May.

Strictly from an estate tax and business succession perspective, this is likely a once-in-a-decade type of event offering you a rare and meaningful planning opportunity. Think back to valuation dips during the dotcom bubble in 2001 and the financial crisis in 2008, followed by the subsequent bull markets. There is a strong likelihood that history will repeat itself in our current circumstance, especially since expectations are to some level of certainty for mitigation, and possibly a vaccine, for the virus in the next 12 – 18 months, if not sooner. When there are dislocations in current values when compared to anticipated appreciation and realization of a higher value in the near future, this presents the perfect opportunity to move such appreciation tax-free to the next generation through what is known as a “freeze transaction.”

There are a variety of freeze techniques available under the Code, all of which have the benefit of locking in the current low value of an asset while passing all the appreciation on to the next generation tax-free. These options include Grantor Retained Annuity Trusts (GRAT’s), Qualified Personal Residence Trusts (QPRT’s), Sales to Intentionally Defective Grantor Trusts (IDGT’s), Intra-family loans, and straight sales – each of which have proven to be quite successful in exploiting similar low valuation/low interest rate environments such as we are experiencing now.

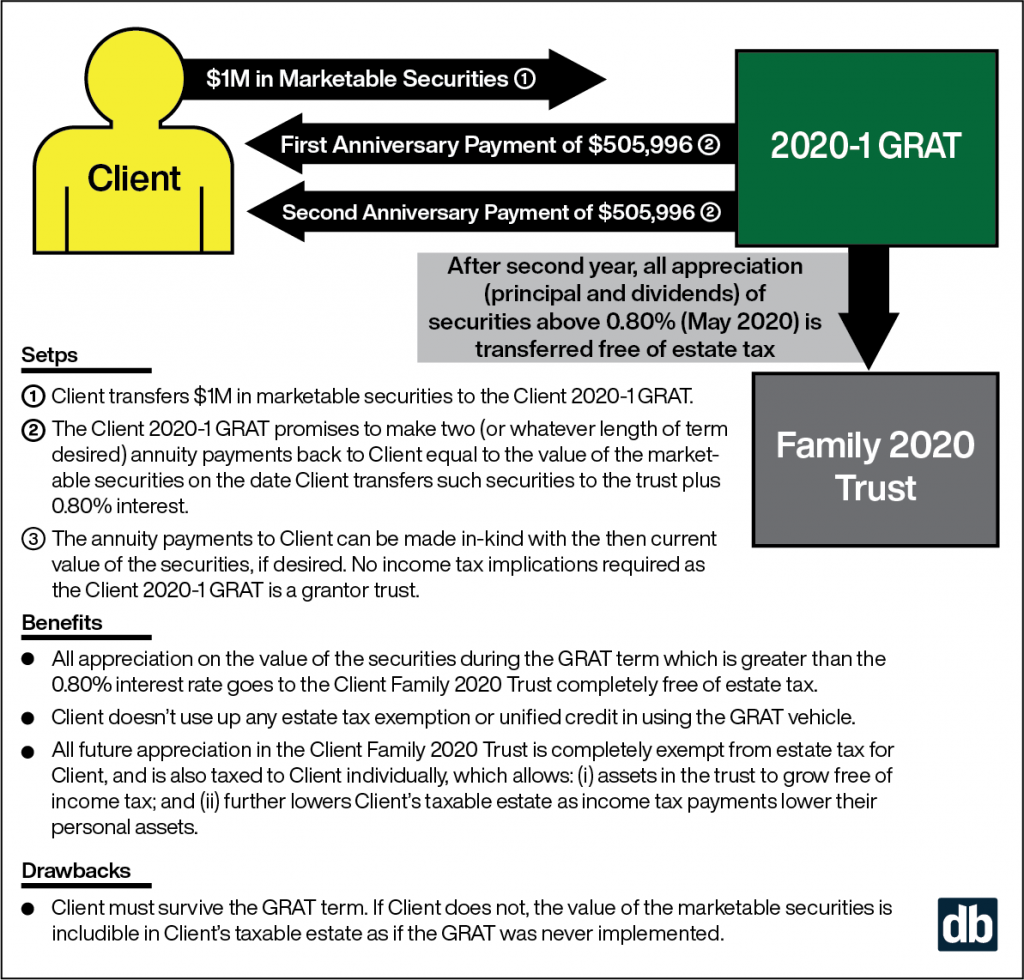

As an illustration of one option, the GRAT, it is a tool that is driven directly from the Internal Revenue Code that allows for a transfer of investments (typically marketable securities or interests in a privately-owned business) by an owner to an irrevocable trust. In exchange for the receipt of these investments, the trust promises to pay back to the owner an annuity equal to the value of the principal received plus interest at 0.80% (for May 2020). After the term of the GRAT, typically 2 years, any appreciation of the investments over the 0.80% interest rate can then be transferred to any person the owner desires, such as their descendants, free of the 40% estate/gift tax. Additionally, if the investments in the GRAT do not appreciate greater than the 0.80% rate, there is no downside risk to losing any gift tax exemption. Please note that GRATs are typically structured as grantor trusts which means the investments can all be transferred between the owner and the trust in-kind without any income tax ramifications at any point. Please see the below schematic as a template visual of freeze transaction using a GRAT strategy:

In short, if you believe (i) your valuations are currently artificially deflated and will rebound in the coming years, and (ii) it is likely your investments will appreciate (both in value and dividends) greater than 1% or so, there are many techniques, such as GRATs, available to take advantage of this environment to isolate and transfer that appreciation on a tax-advantaged basis. DUGGAN BERTSCH would happy to assist you in reviewing your current investment and estate planning structure to determine if a GRAT, or other freeze technique, would be valuable for you to implement at this time.